In January, the expanded child tax credit expired, ending monthly payments to parents across the nation.

The direct payments began as part of the American Rescue Plan in July 2021. They expanded the existing child tax credit of $2,000 per child in 2020 to up to $3,600 in 2021. The Internal Revenue Service distributed half of the fully refundable tax credit in advance via monthly payments.

The result was that qualifying parents would automatically receive monthly payments of $250 or $300 per child under the program, unless they chose to opt out and receive it all during tax time.

It worked much more directly than the regular child tax credit that had existed since 1997. Instead of a lump sum payment during tax season, parents would find the money in their bank account with no paperwork, application or government websites.

As long as working families filed their taxes, they woke up with more money, and no stipulations were placed on how they used it.

Best of all, the federal spending plan did not give Republican lawmakers in Texas a chance to say no and pass up a good opportunity, as they continue to do so with expanding Medicaid with federal dollars from under the Affordable Care Act.

A plan to extend the expanded child tax credit to 2022 and beyond died in Congress, mostly due to Sen. Joe Manchin (D-WV) believing parents would use the money to buy drugs.

Luckily, the Census Bureau has been conducting a major detailed survey throughout the pandemic and throughout the expanded child tax credit’s lifetime, offering the best look at what families actually used the extra cash for.

In a survey conducted a week after the first payments went out, an estimated 4.7 million Texas households received a check. More than two million Texas families used their first child tax credit payment for food, 1.4 million used it for clothing, and with the school year beginning a month later, 1.3 million used it for books and school supplies, according to the U.S. Census Bureau Household Pulse Survey. These figures include 2.6 million families in the Dallas and Houston metro areas who also received checks.

After the tax benefit went into effect, the same Census data found that food insufficiency in households with a child saw a significant decline across the country. A more detailed state-by-state analysis by Washington University in St. Louis found that food insecurity among Texas families went from “severe” to “moderate,” or from 18 percent of families with severe food insecurity to 11.6 percent.

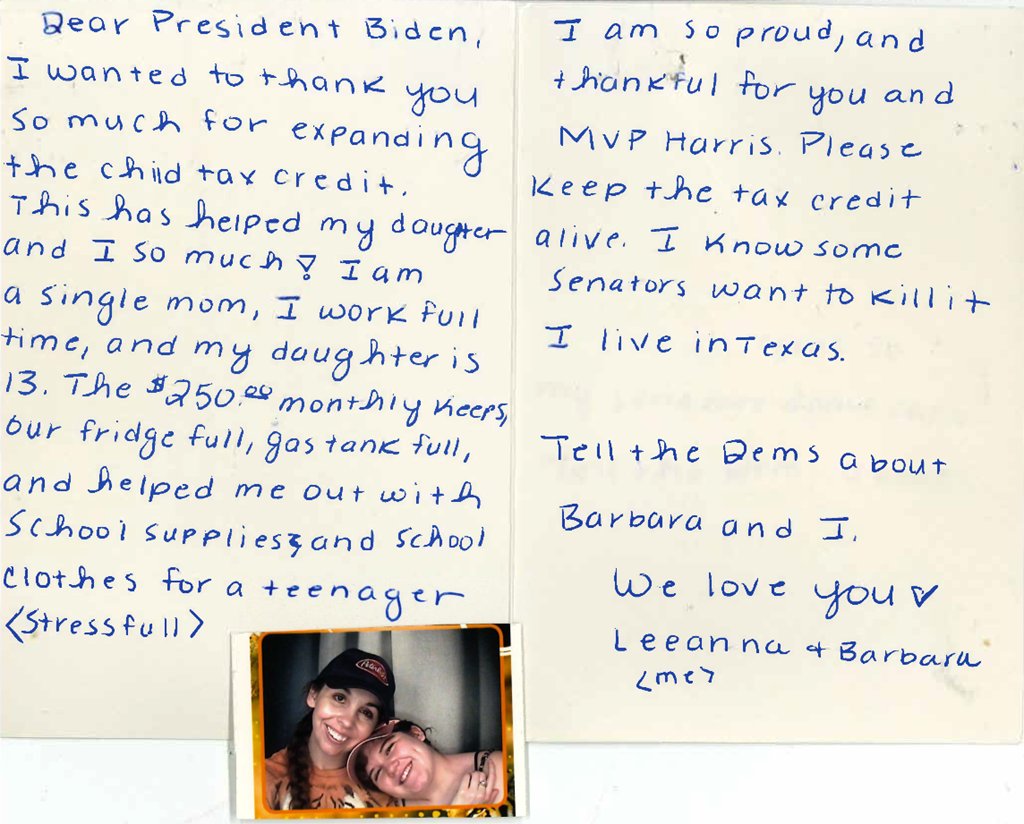

In a letter thanking President Biden and a sample of the tax credit’s real impact, one Texas mother, Leeana, wrote about how the monthly payments helped her daughter Barbara.

“I work full time and my daughter is 13,” she wrote. “The $250 monthly keeps our fridge full, gas tank full, and helped me out with school supplies and school clothes for a teenager (stressful).”

“Please keep the tax credit alive,” she wrote, attaching a photo of her and her daughter. “I know some Senators want to kill it. I live in Texas. Tell the Dems about Barbara and I.”

Graciela Camarena, a program director in the Rio Grande Valley for the Children’s Defense Fund, a nonprofit child advocacy group that did outreach and messaging for the advanced tax credit, said she spoke with families that used the payment for basic necessities like toiletries, rent, mortgage, mechanical repairs for their car, and child care so that they could go to work.

“These are mainly low-income families in marginalized communities that are living paycheck to paycheck,” Camarena said, describing the relief as a godsend and recalling one disabeled mother living on social security.

“She said that was very helpful because her social security check doesn’t go far and it was helpful to buy her daughter school-related supplies and things like that,” Camarena said. “So I think that was very important for families to have that extra support at this time, especially those that don’t have a way to get other types of income or resources available to them.”

With the monthly payments gone, more Texas families are already experiencing the crunch.

Census data shows American families experienced more difficulty in meeting their usual expenses after the loss of the child tax credit payments. A study by Columbia University found that the absence of payments led to 3.7 million more children in poverty, with the child poverty rate rising from 12.1 percent in December 2021 to 17 percent in January 2022.

In Texas, research from the Center on Budget and Policy Priorities estimates more than 1 million children will risk slipping back below the poverty line or deeper into poverty. Overall, 6.6 million children, or 91 percent of Texas children, will lose out on the benefits.

In January, the North Texas Food Bank announced they were preparing for an increase in demand with the expiration of the expanded child tax credit.

Feeding Texas, a network of 21 food banks that reaches 5 million Texans a year, is pushing for the pandemic benefit to become permanent.

“It was a really critically important benefit for the families that we serve,” said Feeding Texas CEO Celia Cole. “With the loss of that benefit, we’re concerned about the one million kids that are going to fall deeper into poverty as a result.”

Cole said Feeding Texas saw a noticeable uptick in need in January when the expanded child tax credit expired. She said the food bank network is still experiencing a 30 percent higher need from communities they serve than compared to before the pandemic.

“You consider the expiration of the expanded child tax credit combined with the extraordinary inflation we’ve seen in food and fuel prices and other goods, that’s kind of a double whammy for the families we serve,” Cole said.

Cole said they’re also concerned with the expiration of the SNAP COVID-19 emergency allotments which allows families applying for Supplemental Nutrition Assistance Program to receive the maximum amount of benefits for their family size. The option for states to offer that increase is expected to end in July 2022.

The Houston Food Bank, which serves 1 million people in 18 counties, is also hoping for the permanent return of the expanded child tax credit.

“We heard from families directly that made a dramatic difference for them,” said Katherine Howard Byers, government relations officer at Houston Food Bank. “Unfortunately with Congress’s decision not to continue the extended child tax credit, many millions of children across the country who were pulled out of poverty are going right back into it.”

Even though Texas is no longer experiencing the height of the pandemic, Byers said Houston Food Bank is still distributing 600,000 pounds of product a day — proof that the need for such benefits remain.

“You hear so much about the economy is opening, more jobs available, and all of that is true, but families that were struggling before were not suddenly able to go into jobs that doubled their income,” Byers said. “They went back to work or had more opportunities to work, but are still struggling on a regular basis and having to make impossible choices.”

To illustrate the point, Byers said she recently spoke to a grandmother who was the primary caretaker for her autistic teenage grandson.

“He’ll get the hot meal or whatever like nutritious food she has in the house, and then once he goes to bed, because she doesn’t want to bring his attention to the fact that she’s barely gonna eat, she grabs a can of food or whatever is sort of left on the shelf and eats it,” Byers said. “And I said, ‘well that’s not good for your health,’ and she said ‘nope.’ What kind of choice does she have?”

For now, the Build Back Better Plan to revive and expand these tax benefits remains dead in the water.

The political fallout for their expiration is already becoming clear. February polling by the Morning Consult showed Democrats had “virtually surrendered” their advantage with families who received the child tax credit benefits, and April polling shows that congressional Republicans now lead in a generic ballot among recipients of the child tax credit — a six point drop in support for congressional Democrats among recipients since the end of the tax benefit.

Fernando covers Texas politics and government at the Texas Signal. Before joining the Signal, Fernando spent two years at the Houston Chronicle and previously interned at Houston’s NPR station News 88.7. He is a graduate of the University of Houston, Jack J. Valenti School of Communication, and enjoys reading, highlighting things, and arguing on social media. You can follow him on Twitter at @fernramirez93 or email at fernando@texassignalarchive.com