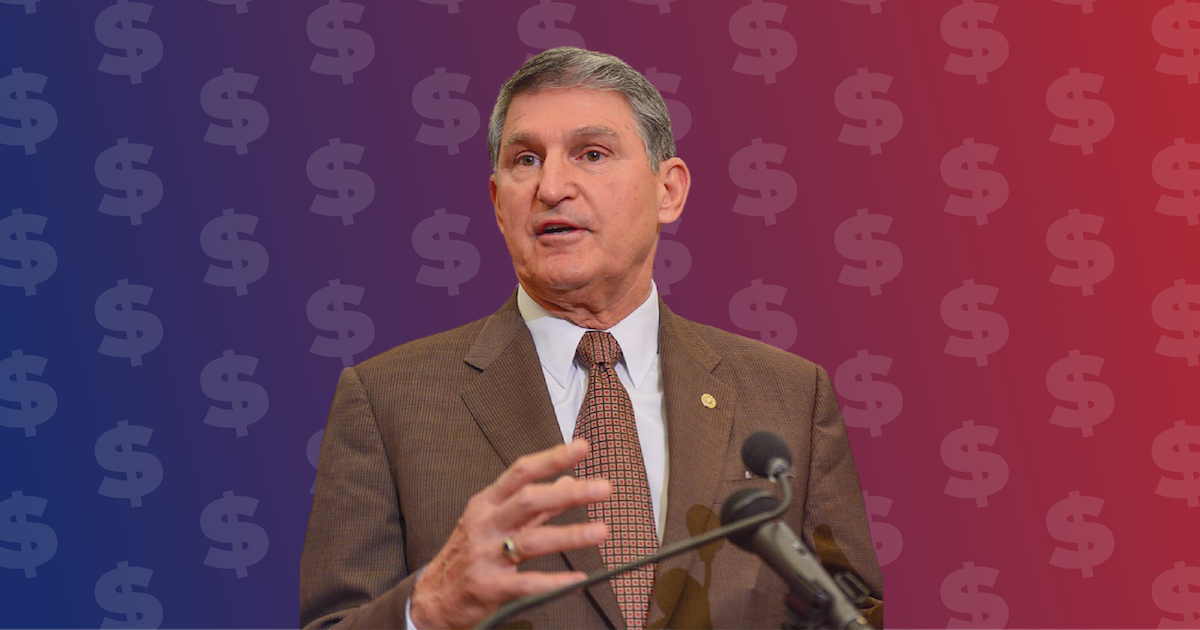

The White House’s budget released Monday included a new tax on billionaires but it didn’t take long for Sen. Joe Manchin (D-WV) to throw cold water on the idea.

The proposed “Billionaire Minimum Income Tax” would impose a new minimum tax of 20 percent on households with assets of more than $100 million. This would apply to only 30,000 families, about .01 percent of Americans.

The tax would work by taxing “unrealized gains,” in other words potential profits from the appreciation of assets that have not been sold. It would be similar to a wealth tax, but since it only taxes increases in wealth it can be considered an income tax and thus gets around the constitutional issues with wealth taxes. Since the 16th Amendment allows the government to tax income but not wealth, courts have ruled that wealth taxes are unconstitutional (this is controversial).

While the tax code is supposed to be progressive, the preferential treatment for capital gains (where the ultra-wealthy get most of their income) means the richest 400 families in America now pay a lower tax rate than the middle class. As a result, efforts to make sure billionaire’s pay a minimum tax have been floated for a while. One early proposal was the Buffett Rule, named after the billionaire investor who famously stated that he paid a lower tax rate than his secretary. A more recent proposal was Sen. Ron Wyden’s (D-OR) Billionaire Income Tax, which caused Elon Musk to throw a very juvenile twitter tantrum.

The Biden administration’s plan is similar to Wyden’s though it’s been modified to make it more palatable to Congress and the courts. The White House estimates that it would raise $360 billion over ten years.

While polls show strong support among voters for higher taxes for the wealthy, Manchin was quick to shoot down the idea, as he has often done to Biden’s policy agenda. Manchin would not support a tax on unrealized gains, even though his state ranks second-lowest in median household income and Biden’s proposal would only affect the top .01 percent.

Tax reform has never been easy, and it’s particularly difficult given the razor-thin margin that Democrats have in both chambers of Congress. An additional tax on the rich is something that is highly unlikely to garner Republican support, so the prospect of billionaire’s paying their fair share will probably remain aspirational for some time.

Original Photo: Senate Democrats

William serves as the Washington Correspondent for the Texas Signal, where he primarily writes about Congress and other federal issues that affect Texas. A graduate of Colorado College, William has worked on Democratic campaigns in Texas, Colorado, and North Carolina. He is an internet meme expert.