Texas has some of the highest property taxes in the country, and they’re undergoing a steep inflation as home values across the state continue to increase. Both major political parties have plans to address this financial burden, but Republicans are now weaponizing growing frustration with higher property taxes to enact potentially permanent budget cuts to the public school system.

The fundamental reason that property taxes are so high is that Texas does not have a state income tax. Instead, we pay for government services through two main sources of revenue: sales tax and property tax.

Though a tailored state income tax could lower most Texans’ overall tax burden by decreasing the amount low-income homeowners pay in property taxes while generating additional revenue by taxing the income of the wealthiest Texans, such an income tax as Democrats might desire will not happen anytime soon due to the potential backlash from moneyed constituents.

That being said, homeowners of all incomes dislike property taxes, and they regularly vote to lower them. As recently as May 7, Texas voters overwhelmingly passed a pair of statewide ballot measures aimed at decreasing property taxes. While measures like alleviating tax pressure for the old and disabled sound reasonable, it’s likely that at least some local governments will now have to cut their property tax rates and thereby lower the municipal funding available for public schools.

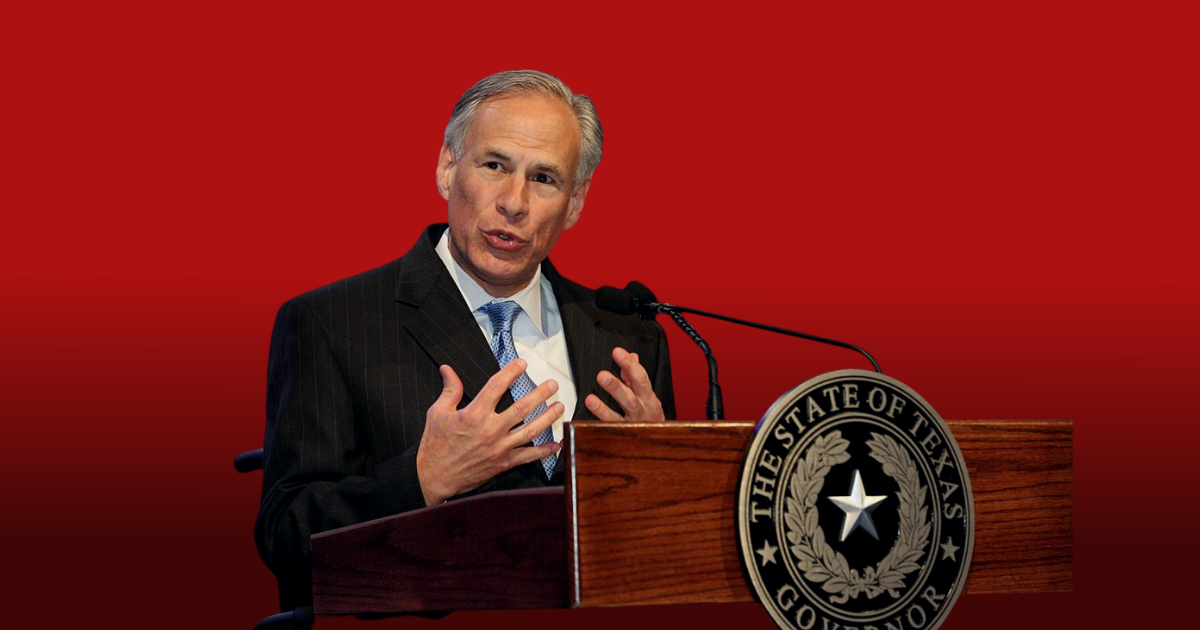

Greg Abbott’s plan to address the rising property taxes is to tap into the state’s projected treasury reserve. “I strongly support using the state surplus to reduce the amount of property taxes owed,” said Abbott to Houston’s KPRC 2. As projected by Republican Comptroller Glenn Hegar, Texas’s projected surplus is nearly $24 billion.

Abbott’s plan seems logical at first, but even the conservative Hegar admitted that these billions are merely a future projection rather than a current reality. Citing uncertainties over inflation, energy prices, labor availability and global supply chain bottlenecks, he told The Dallas Morning News how important it is “to always leave a little money in the bank because you never know what the economy’s going to do.”

Without accessing these funds though, options to decrease the burden on Texas taxpayers are limited.

“The only way to really institute meaningful property tax reductions would either be to find some other revenue source or to substantially cut education budgets,” said Texas A&M research economist Dr. Charles Gilliland in an interview with the Texas Tribune.

To make the budget math work, Governor Greg Abbott will likely attempt to re-energize the Texas GOP’s platform idea of significantly raising the state sales tax, which would allow the reduction of property taxes but put an even greater burden on the state’s poorer, non-homeowning residents.

Even if he abstains from pushing this radical tax reform, Abbott is already using the allure of a popular tax break for Texans to advance the conservative proposal of permanently eliminating the school district maintenance and operation component of property taxes, the biggest portion of the school property tax. This depletion of taxpayer dollars from public schools fits in with Abbott’s recent full-throated support for a school voucher plan, which would allow taxpayer dollars to be used for private schools.

Critics of vouchers say they hurt the state’s education system. “Abbott is for defunding our public schools,” Democratic gubernatorial candidate Beto O’Rourke tweeted. “I’m for fully funding our kids’ classrooms and fully supporting parents, teachers, and students.”

The Association of Texas Professional Educators has also chimed in to admonish Abbott, releasing a statement criticizing the governor for, “attempting to capitalize on trendy political rhetoric by mislabeling vouchers as a ‘parental right’ and ignoring the facts: Texas voters support Texas public schools.”

Abbott has sought multiple times to assuage concerns about public school funding, insisting that a voucher plan “does not mean that public schools will not be fully funded — whether they are urban, rural, suburban.” However, vouchers have long been a tough sell in the Texas Legislature, partly from rural Republicans concerned about the health of public schools in their districts.

In contrast to Abbott’s dangerous property tax scheme, O’Rourke has put forth a set of ideas to reduce Texans’ property tax burden without cutting funding for public schools or increasing taxes on low-income earners. This would include making sure that the state picks up 50% of the tab for public schools, expanding Medicaid to ease the property tax bill for publicly funded hospitals, as well as legalizing marijuana and taxing its sale.

Whatever the near future of Texas property taxes though, these dueling Republican and Democratic plans will undoubtedly affect the lasting health of Texas’s public school system, the fate of which will be on the ballot as Texans head into voting booths this November.

O’Rourke was in Dallas on Wednesday speaking on property tax hikes that people are seeing around the state of Texas. He spoke in south Oak Cliff, where he said some families are on the verge of being priced out.

The Democratic candidate for governor shared solutions to help ease the anxiety some families are facing with climbing property taxes in the state. In a direct effort to reduce property taxes, he talked about leveling the playing field for homeowners and corporate property owners through legislation.

“Corporate property owners are able to bring down their bills by billions of dollars every year,” O’Rourke said. “As governor, I’m going to make sure we have full sales price disclosure in the state of Texas, which means homeowners and renters will pay less going forward.”

He also said he would work with local governments to increase housing inventory and address shortages and increasing the state’s portion of funding for public education. More controversially, he talked of expanding Medicaid and legalizing marijuana.

He said both the latter proposals would increase the revenue streaming into the state, which would allow for the reduction of property taxes at the local level and addressing public policy issues that have been central to his campaign.

“In the ninth largest economy on the planet in the wealthiest country in the world, it is not for lack of resources, it is for lack of political will and leadership right now,” O’Rourke said in response to a question on whether the state has the funds to expand Medicaid and increase its share of public school funding.

“When current leadership is more invested in stunts like shutting down commercial trade at the border, like spending $5 billion on political theater where our state meets Mexico and the rest of the world, those are resources that could have been invested in public education, for example, to meet that 50% goal that is totally attainable,” he said.

It’s true, Texas has some of the highest property taxes in the nation, even though we are a low-service state.

Many folks direct their anger at their appraisal district, but that’s misguided. The appraisal district is largely just a technocratic middleman. The appraisers didn’t create the property tax system, nor are they responsible for the red-hot housing market in many of Texas’s cities and suburbs. It’s also easy to get mad at the local taxing entities—your school districts and cities and counties—but they did not design Texas’s system of funding government and are increasingly faced with unfunded mandates from the state. For the most part, taxing entities have been lowering their tax rates year after year. Finally, it’s a Texas pastime to blame Californians for the rising cost of housing here, but there’s not much evidence that new residents are the problem.

The fundamental reason that property taxes are so high is that Texas does not have a state income tax; it’s one of only seven states in the nation without one. Instead, we pay for the government through two main sources of revenue: sales tax and property tax. “Most states rely on that three-legged stool of income tax, property tax, and sales tax,” pointed out Chandra Villanueva, a policy analyst with the left-leaning nonprofit Every Texan. “When you’re on a two-legged stool, it’s not very stable.”

A well-designed, progressive income tax could actually lower most Texans’ overall tax burden by decreasing how much low- and middle-income homeowners pay in property taxes while generating additional revenue by taxing the income of the wealthiest. But an income tax ain’t gonna happen in the foreseeable future—it’s about as politically popular at the Capitol as banning barbecue.

Long a fringe proposal, the notion of scrapping property taxes has become somewhat more mainstream in recent years. In 2019, while debating the twin issues of school finance and property taxes, many top Republican lawmakers—Governor Greg Abbott included—floated the idea of raising the state sales tax to a rate that would match California’s, the highest in the nation. The idea proved toxic even for many Capitol conservatives.

Lieutenant Governor Dan Patrick has instructed a group of senators to study the possibility of eliminating the “maintenance and operations” tax, the biggest portion of the school property tax, ahead of the 2023 legislative session.

What are the driving forces behind property taxes appraisals skyrocketing? The large number of people moving into Texas, limited inventory of new and pre-owned construction, interest rates being at historic lows in recent years and more people working remotely, are all fueling the surge, according to the Harris County Appraisal District. Doug Freer of the Nicole Freer Group says every neighborhood is seeing homes go on the market and not last very long.

“Everywhere is a seller’s market right now,” said Freer.

“I strongly support using the state surplus to reduce the amount of property taxes owed,” said Abbott to KPRC 2 Investigates.

The simple solution for his non-partisan group is for the legislature to tap into the state’s surplus of nearly $24 billion.

The strategy is to use part of the surplus to pay down the biggest fee homeowners face, their school district maintenance and operations tax.

While he supports using the state surplus, Abbott believes lawmakers should also eliminate the school district maintenance and operation component of property taxes, adding the approach should not be a one-time buy down.

A couple of weeks ago, Comptroller Glenn Hegar said the state will bring in almost $23 billion more in general revenue during the current two-year budget period than he originally estimated.

He’s expecting the state to end the current budget period, which runs through August 2023, with almost $12 billion in the bank, and with an additional $12.6 billion in the state’s Economic Stabilization Fund, more commonly known as the Rainy Day Fund.

The traditional caveat on comptroller forecasts was in the fine print: Hegar said COVID-19, supply-chain problems, inflationary pressures and labor shortages could slow or derail the economic train.

Until the general elections next November, politicians can paint the prettiest pictures they want, proposing new programs, services, tax breaks and whatever else they and their consultants dream up. When voters ask how they’ll pay for it, they’ll point at those rosy projections of bulging state treasury vaults.

They won’t have to do the math until after the elections.

Comptroller Glenn Hegar shrank from urging any such “investments,” citing uncertainties and a need for fiscal caution.

“It’s not as though we just ended the legislative session with $24 billion in the bank,” he told The Dallas Morning News as he certified his revenue estimate from January is still adequate to cover state spending.

“This is an expectation,” he said of his certification, “not a guarantee of what may be in the treasury. It’s important to always leave a little money in the bank because you never know what the economy’s going to do.”

Hegar cited uncertainties over inflation, energy prices, labor availability and global supply chain bottlenecks as grounds for circumspection.

Texas has the nation’s highest share — and number — of residents lacking health insurance. Urban breadwinners have emerged from COVID-19 lockdowns to return to work — and crowded freeways. Experts have warned of wastewater and electric grid needs. Community colleges have suffered a dramatic 11% decline in enrollment since the pandemic began.

But Hegar, asked if he would use his megaphone as the state’s chief tax collector and fiscal officer to recommend selective increases in spending, said it’s “very prudent” to wait through 2022 to see if his revenue projections are on target. The 2023 Legislature can then “make some decisions on how they prudently want to use these dollars — if the numbers bear out.”

Over the weekend, Texas voters overwhelmingly passed a pair of statewide ballot measures.

Proposition 1 will essentially cut school district property taxes for homeowners 65 and older or those who are disabled. Proposition 2 will raise the state’s homestead exemption, or the dollar amount of a home’s value that’s exempt from taxation by school districts. About 87% of voters supported proposition one, while about 85% supported Proposition 2.

However, property tax relief does not benefit renters, who have seen skyrocketing rents across the state.

“Renters will only benefit if there’s across the board rate reductions,” he said. “So the only way, unfortunately, for renters to get relief is for property taxes on those landlords to come down and let the market adjust.”

It’s likely that at least some local governments will have to cut their property tax rates in order to fall in line with recent state laws meant to slow property tax growth. And the state’s top elected officials are already making new promises to bring down Texans’ property tax bills. But recent laws haven’t stopped property tax growth altogether.

Property tax collections have risen more than 20% since 2017, according to data from the Texas comptroller’s office. Texans paid an estimated $73.2 billion in property taxes in 2021, which went to school districts, cities, counties and other taxing entities that then use the revenue to fund everything from public schools and police departments to road maintenance.

Texas’ local governments rely heavily on property taxes to pay the salaries of police officers and firefighters and for government services like roads, libraries, parks and public schools. Coupled with the fact that Texas has no state income tax, Texans’ property tax bills are among the highest in the nation.

In no arena is that more apparent than in Texas’ public schools — which depend greatly on property taxes for funding. School districts use local property tax revenue to cover as much of their base budgets as possible — then the state chips in the rest. Over time, that formula has often resulted in fewer state dollars paying for public education as local property values have grown.

In any given year, revenue from property taxes makes up more than half of the state’s pot of funds to pay for public schools, the rest of which comes from state and federal sources. Of the $69.3 billion that went to public education in fiscal year 2020, property taxes kicked in $38.4 billion while the state provided $23.3 billion. The rest came from federal funds. As a result, school property taxes make up the bulk of a typical Texas homeowner’s tax bill. More than half of all property tax revenue in the state comes from school property taxes, according to data from the Texas Comptroller’s office.

“The only way to really institute meaningful property tax reductions would either be to find some other revenue source or to substantially cut education budgets,” said Dr. Charles Gilliland, a research economist who studies property taxes at the Texas Real Estate Research Center at Texas A&M University

Abbott has touted a “taxpayer bill of rights” that includes proposals to further reduce school property tax rates, make property appraisals more transparent and limit local governments from taking on new debt without voter approval.

O’Rourke put forth a set of ideas to reduce Texans’ property tax burden. That would include making sure that the state picks up 50% of the tab for public schools, expanding Medicaid to ease the property tax bill for publicly funded hospitals, plus legalizing marijuana and taxing its sale.

One idea that has gained momentum in Republican circles is the abolition of school districts’ maintenance and operations tax, which Patrick instructed senators to look into this year. Craymer, the TTARA (Texas Taxpayers and Research Association) president, is dismissive of that. “I don’t think we’re getting rid of the school M&O tax anytime soon,” Craymer said. “I don’t think we’re getting rid of the property tax anytime soon.”

Gov. Greg Abbott on Monday voiced support for a school voucher plan, offering his clearest embrace in recent memory of letting parents use taxpayers dollars to send their kids to nonpublic schools.

“We can fully fund public schools while also giving parents a choice about which school is right for their child,” Abbott said during a campaign event in San Antonio. “Empowering parents means giving them the choice to send their children to any public school, charter school or private school with state funding following the student.”

Critics of vouchers say they hurt public schools, an argument that Abbott’s Democratic challenger, Beto O’Rourke, quickly made after the governor’s remarks.

“Abbott is for defunding our public schools,” O’Rourke tweeted. “I’m for fully funding our kids’ classrooms and fully supporting parents, teachers, and students.”

Abbott sought multiple times to assuage concerns about public school funding. He insisted that a voucher plan “does not mean that public schools will not be fully funded — whether they are urban, rural, suburban.”

“If you like the public school your child is attending, it will still be fully funded,” Abbott said.

Abbott held the event as part of a focus on “parental rights” in his reelection campaign. Echoing Republicans nationwide, he has vowed to give Texas parents more say in their kids’ education, including over the curriculum they are taught and the types of schools they can attend.

The Association of Texas Professional Educators said Abbott was “again attempting to capitalize on trendy political rhetoric by mislabeling vouchers as a ‘parental right’ and again ignoring the facts: Texas voters support Texas public schools.”

“Texas voters elect lawmakers who support Texas public schools,” ATPE executive director Shannon Holmes said in a statement. “And Texas voters know the truth about Texas public schools.”

Vouchers have long been a tough sell in the Legislature, where the idea tends to draw bipartisan opposition in the House, partly from rural Republicans concerned about the health of public schools in their districts.

Original photo: World Travel & Tourism Council